How I Used Swing Trading & Managed My Risk

Recently, DJI closed above 29000 and SP 500 rallied to an all-time high. The gains came as US and China aimed at easing tensions between the two economic giants.

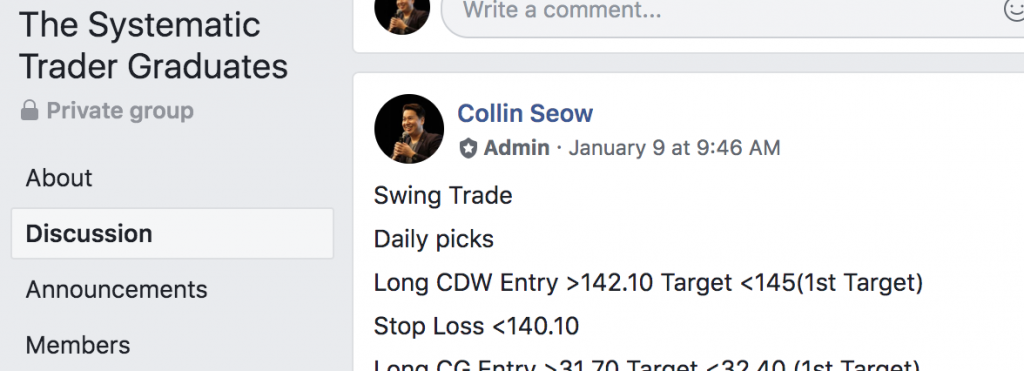

As usual, I was scanning for stocks for The Systematic Trader graduates group for both short term trades (< 5 days) and long term trades (3-9 months).

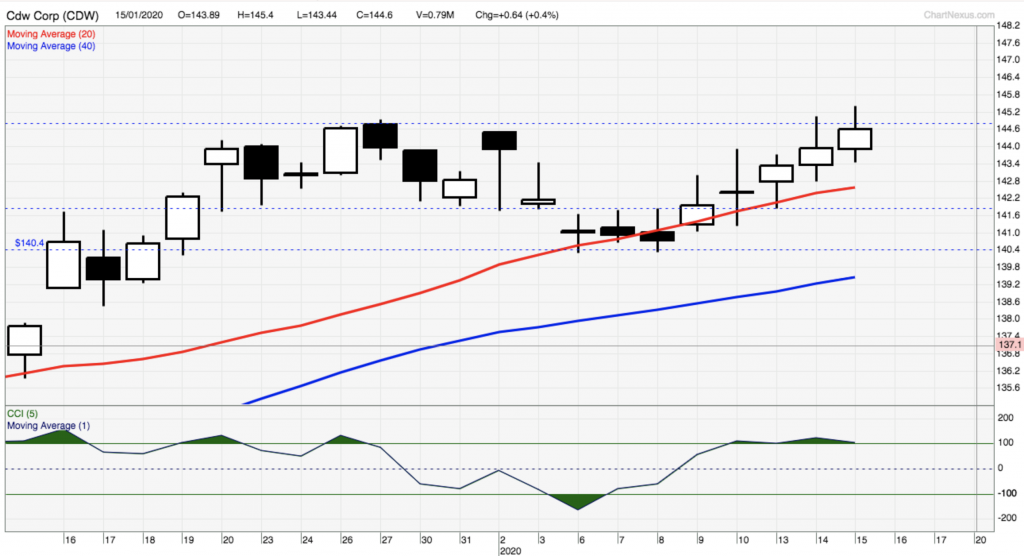

I managed to spot this stock CDW on the 9th of Jan 2020, this is a textbook swing buy setup for me. You can learn more about swing trading with the video here >> Swing Trade

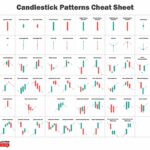

Swing Trade BUY Setup Rules

- Sloping up 20 MA and 40 MA

- 20 MA above 40 MA

- CCI < 100

- Low below 20 MA

- Close above 40 MA

This was a swing trade for a few days.

Usually, we will risk about 2% of our capital.

For Example, if your capital is $10000, 2% will be $200.

To calculate what is the size of the trade, I will use $200 divided by (Entry Price – Exit Price) i.e. $200/ (142.10-140.10) = 100 shares.

So I will then proceed to buy 100 shares of this stock at 142.10.

If I sell at the target price of 145, my profit will be $290.

This is a quick 2.9% returns over a few days.

Then I will rinse and repeat for the next stock.

Hopefully, I can pick out one today.

The setup is fixed, just make sure the selection of stocks is good.

I have seen that many still manage to choose ugly setups even when the rules are clear.

But if you can do it consistently, it is akin to like an ATM from the stock market.

Trade awesome!,

Collin