Small-Cap Growth Stock With Low Debt

Just over a month ago, the Fed raised interest rates by three-quarters of a percent, marking the largest hike in 20 years. According to CNBC, We’re currently in an environment of rising interest rates due to inflation, and the market situation hasn’t exactly been the best.

We’ve seen the NASDAQ and S&P 500 drop to a low of about 10560 and 3630 respectively as money rotated out of stocks for fear of a recessionary scenario.

With current market conditions, it is imperative that we choose our investments wisely. One area which I will like to bring to my readers’ attention is a company’s use of debt.

The Current Debt Situation

At first glance, it may seem that companies with high debt would surely stand to lose big as they now have to pay more interest on their debt.

However, there is a catch – in a high inflation environment, debt itself loses value as the value of money itself erodes. As such, any outstanding debt is now worth less than it was before inflation.

The Push & Pull Factors

To summarize, we see 2 forces here – 1) interest on debt is higher due to rate hikes, but 2) debt itself is worth less due to inflation.

Nevertheless, considering the decrease in spending and rotation of money into savings instead of non-essential goods and services, companies with high outstanding debt may find it more difficult to finance these obligations due to a decline in their profitability, even when their debt is worth less (remember that their cash on hand is now worth less too!).

Don’t forget that they also have to pay higher interest on their debt, even when they could potentially be generating significantly lesser cash flow due to decreased demand.

In comparison, companies with low debt and strong cash flows are less vulnerable to rate hikes as they can easily finance these obligations even if their profits stall due to less consumption of their goods and services.

In addition, the company can use its cash flows to carry out mergers and acquisitions, issue dividends, repurchase shares, and/or reinvest into the company to provide better goods and services; companies with high debt and weak cash flows, on the other hand, do not have this flexibility.

As such, in my humble opinion, I would personally prefer to invest in companies with low debt and strong free cash flow generation where credit risk is low since the possibility of a recession is now very real.

In this article, I will highlight 1 relatively unknown company that have strong growth potential.

However, unlike many hyper-growth stocks that the media used to love, stocks such as Peloton, Palantir, Fastly, etc where these companies are typically loss-making, cash-burning entities, this small-cap stock is highly profitable and more importantly, have extremely low credit risk due to their cash-generating abilities as well as a conservative balance sheet status.

This company is a small-cap stock that fall under the radar but is well-positioned to potentially ride any downcycle in the economy and emerge in one piece as they have low credit risk. The same cannot be said of cash-burning hyper-growth stocks that are at risk of 3rd party funding drying up.

Do note that this is not a recommendation to be buying these shares. Please do your due diligence to decide if these small-cap stocks are suitable for you as they are inherently more volatile in terms of their price movement.

Small-Cap Growth Stock With Low Debt: InMode Ltd (INMD)

InMode is a medical technology company focused on beauty care and treatment. The company is best known for its treatment products for contouring, hair removal, and feminine wellness.

The company itself is an attractive pick as the beauty industry is starting to see a rebound (Source: Reuters) after a steep decline caused by the pandemic. InMode is at the forefront of creating non-invasive technology for treatment products for the face and body, and it has won awards for many of its products like Evoke and EvolveX.

Business Model and Financials

The company has shown a sustained increase in its bottom line, with net income rising from $8.82m in 2017 to $164.97m in 2021, representing a 1770% overall increase.

We see from the graph above that revenue and earnings have been on a strong upward trend from 2018 to 2021. This is a good sign that the company is profitable and is also being run efficiently. The impressive quality of InMode’s offerings, which are said to be bringing a “paradigm shift to cosmetic procedures” (Source: Fool.com), is a large reason why the company can keep its sales and net income up.

Another impressive metric to consider is the company’s free cash flow growth. The company’s free cash flow has increased from $14.42m in 2017 to $173.95m in 2021 – this is an 1106% overall increase. In comparison, the company has $62.74m in total liabilities, with only $4.5m of it being debt (ST & LT) as of 2021.

In addition, we see that the company’s earnings have beaten analyst estimates (for earnings-per-share) in the last four quarters, hence further indicating strong financial performance.

Technical Analysis on InMode Ltd

The short-term price chart of InMode looks good! After a long and persistent downtrend since Dec 2021, it is starting to show signs of a reversal from a few weeks back, while the general market is still dropping.

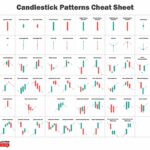

From the chart above, you can see that there were 2 green arrows under the candlestick on the 12th and 20th of July.

You can also see that the bar of the Trend Impulse Factor for those days was in dark green. This meant that the bulls are present and strong.

Since the opportune time to buy shares of INMD for a position trade was a couple of days back, should you enter now?

The boat has sailed.

Will the boat return? Will there be a sensible and good opportunity for a position trade?

I think so. What you’ll want to see is an agreement of both indicators – the appearance of the green arrow and the bar of the Trend Impulse Factor turning dark green on the same day.

That would be a confirmation that another uptrend is here and the bulls are out to stay, shifting the chances of success to your side.

Being in a more volatile environment, it pays to be extra patient in the stock market.

Conclusion: Recession Proof Small Cap Growth Stock

All in all, we see that the company is not only reporting strong earnings, but is also more than able to pay off its debt, and all its other liabilities as well. This is a good sign, especially in current times of high-interest rates, since the company has very low debt and hence low cost of debt and low cost of capital.

Given the company’s strong generation of free cash flow, InMode has the flexibility to issue dividends, buy back shares, or invest in R&D to create new non-invasive beauty treatment products. Given the high quality of InMode’s offerings, we have good reason to believe that it will continue to create new methods and technologies to provide effective beauty treatment. If you wish to invest in medical technology specifically for the beauty industry, you can put InMode on your radar.

From a short-term trading perspective, although the boat has sailed, it is worth keeping an eye on this stock to wait for the next confirmation sign – where the green arrow appears together with the Trend Impulse Factor indicator.

After all, the green arrow and Trend Impulse Factor indicators have been tested and proven. They form the TradersGPS (TGPS) system to help you decipher if a stock is a cut above its peers. You won’t have to feel in the dark and make wild guesses.

Did You Know?

The ones who make the MOST money from the stock market actually spend the LEAST time.

Yet, most people tend to spend hours reading news or analyzing charts, only to be caught in a never-ending spiral of disappointment from the stock market.

The truth is, profiting from the market is all about trading smart, not hard. And this is the very secret of all top retail traders and investors.

They all have a system they follow.

A system that helps them identify winning stocks fast and filter away dangerous risky ones, a system that tells them exactly when to buy and sell and eventually exit the stock with profits.

It’s like having a personal guide telling you exactly what to do from start to finish. One that is not only reliable in aiding your investment journey, but also saves you time, energy and stress.

So if you wish to start building an additional stream of income through the stock market the SMART way, not the HARD way…

Come and join me in my upcoming LIVE demonstration webclass where I will demonstrate LIVE how ANYONE, even with no experience can learn and adopt a really simple system and apply almost immediately to start profiting in the markets.

Click HERE to register your seat before we hit full capacity!

If you’d like to learn more about systematic trading to better time your trade entries, click the banner below: