Systematic Trading (Feb 2022): Apple & True Corporation

“There is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

– Jack Schwager

It’s now the sixth part of our series on Systematic Trading!

It’s been pretty interesting to take up the challenge of finding and testing out stock ideas, especially the ones from markets that I am not at all familiar with.

Some examples from relatively recent parts would be…

- Article 5: Tata Motors (BSE), and Shell Midstream Partners (NYSE);

- Article 4: Indofood (JSX), and McDonald’s (NYSE);

- Article 3: Genting (KLSE), and Nvidia (NASDAQ).

Of course, these ideas are by no means stock tips. In fact, like we see in article 5, we find that these may not even be ideal candidates to trade at all.

In any case, there’s always learning to be gained when looking at the charts.

This process of practice and simulation certainly helps in the long-run. If there’s anything to remember, it’s to be patient and wait for the set-up.

Oftentimes the fear of missing out makes us act out of irrationality. We feel that we might “miss the boat” if we don’t act now. While that may be true, there is also no lack of stocks to trade.

This begs the question: Why take on a trade which is of lesser probability?

We can’t always be right about the trades, but we can find methods that work.

So this is what this series is about – checking out how systematic trading works, as opposed to discretionary trading.

Quick Comments On Stock Selection: AAPL & TRUE

The last 2 articles featured counters on the NYSE, so I thought it’s about time to rotate back to the NASDAQ. The obvious choice would be to pick one of the FAANG stocks – and since we’ve already looked at Facebook (or rather, Meta Platforms) in article 2, we’ve moving down the acronym…

Indeed, we’re looking at Apple this time.

As for the other counter, by means of elimination, it will look something like: SGX/KLSE/HKSE/SZSE/SSE/BSE/NSE/JSX/SET

Among these, I was more inspired to look at the SET (Stock Exchange of Thailand) partially because of the news of extended vaccinated travel lanes.

On that note, the choice of True Corporation is related to travelling because of its business in the communication sector. It wasn’t too long ago that we would consider purchasing a SIM card (from True Corporation or its competitors) so that our phones would still have data connection while on our Thai escapades…

Anyway, let’s bring our attention back to this and get on with the charts.

Apple Inc. (NASDAQ: AAPL)

1. About The Company

“Apple Inc. designs, manufactures, and markets personal computers and related personal computing and mobile communication devices along with a variety of related software, services, peripherals, and networking solutions. Apple sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers.”

Source: Bloomberg

2. Position Trading (Daily)

If you’ve been following this counter, you would know that AAPL has had a bull run for most of 2021.

When it comes to 2022 though, there’s been some correcting going on. Given the recent changes of candle colour from blue to red, blue and red again, and currently blue – this is a noisy period and would not be ideal to trade for this position daily strategy.

When it comes to 2022 though, there’s been some correcting going on. Given the recent changes of candle colour from blue to red, blue and red again, and currently blue – this is a noisy period and would not be ideal to trade for this position daily strategy.

Nonetheless, if you’ve managed to follow the entry signal on TradersGPS in late November around $155, you would have exited with some profits around $169. This is it dipped further even nearing the entry price.

3. Swing Trading (Weekly)

At a glance, do you notice that AAPL has rarely broken below the 40-moving average?

There have been a few swing set-ups this past year, but let’s focus on the latest one, just last month in January. On the set-up candle, we see that the low was at $154, but the candle closed higher than its 40-moving average. Practicing some knowledge on candlestick patterns, this indicates that there is buying pressure, and potentially a reverse in prices from its prior downward move.

This trade would be triggered as the next candle broke above the high of this set-up candle at $170. At present, it remains to be seen if this would be a profitable trade. While it has not yet hit the stop-loss level – either following the TradersGPS Dynamic Stop Loss indicator, or the previous candle low – it is currently a losing trade with the current price at $167.

4. To Trade Position Daily Or Swing Weekly?

Well, the position daily trade would not be an option at this current juncture. While the swing weekly strategy would be an option, and historically AAPL has shown that it is a strong stock, it is worth considering the risk-to-reward ratio.

If the profit target is placed at the previous swing high, this would mean the levels of about $180. At an entry of $170 and a stop-loss at $154, it will be up to you to decide if the risk is worthwhile. Personally, I would prefer to look for a trade that has better risk-to-reward payoffs, rather than rush into a trade.

True Corporation. (SET: TRUE)

1. About The Company

“We strive to make life better for everyone. Through unique combination of innovative technologies, we can enhance experiences on all levels. It means the greater ability to access information, news, and entertainment.” …

“In our latest mission to become the best mobile service provider in Thailand, we are the first to acquire the high speed of 4G for seamless online lifestyle.”

Source: Corporate website

2. Position Trading (Daily)

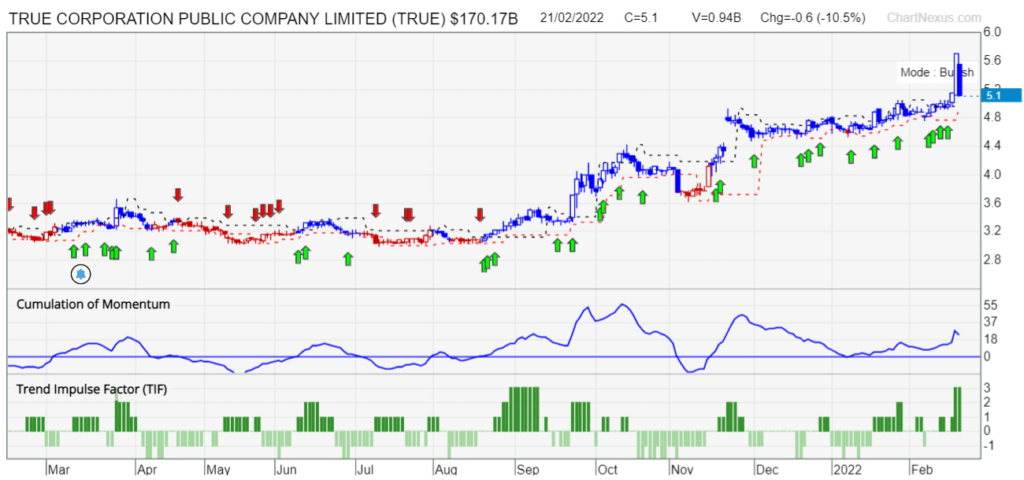

There have been numerous buy signals on the TradersGPS 1-year chart, which is unsurprising given the uptrend the last 6 months:

Taking into consideration that there were exit signals in November, the next round of entry signals would be in the second half of November around 4.4 THB. Entering upon the first signal would mean a profitable trade given its current price at 5.1 THB.

Of course, whether it would trend higher remains to be seen, but what we do know is that there was a period of consolidation prior to the upward move from September. Given the many green arrow with TIF signals that have already appeared since then, it would typically not be wise to enter further positions.

3. Swing Trading (Weekly)

Let’s just say that a chart this like would be one of many variations you would see in the markets:

There has been no valid swing set-up for this past year!

It has been trending sideways, as seen from the flat moving averages, until the spike in mid-September. From then on, the only time that price was oversold at end October/early November did not dip below 20-moving average.

Hence, there has not been any valid set-ups as the conditions have not been fulfilled.

4. To Trade Position Daily Or Swing Weekly?

Contrary to AAPL’s case, for TRUE, there is no swing weekly set-up and only the position daily strategy can be considered. In which case, this trade would have done well in catching the leg upwards. While it almost had an exit signal in January when the candle turned red, the next candle turned blue and thus there were no exit signals since November.

A typical position daily trade is expected to last between 3-9 months. In this case, it about the 3rd month since an entry at 4.4 THB.

Conclusion: AAPL & TRUE

Although a stock’s historical performance does provide clues, it is also worth considering the present risk-to-reward conditions. As we see in the case of a swing weekly trade for AAPL, it is up to your own preference to decide if it would be a worthwhile trade.

On the other hand, we see TRUE trending sideways and finally breaking higher from September onwards. With a systematic way of getting in and out, you would be able to lock in profits. Furthermore, position-sizing plays a part in deciding how much to go into the counter. In which case, if there are already several entry signals, it may not be wise to chase after the counter.

While we can attempt to investigate the reasons behind the charts, it is also about reacting to the charts rather than attempting to anticipate.

There is simply no way to accurately predict whether it would trend up or down.

However, with the help of indicators to decipher the charts, coupled with a systematic approach to trading… It doesn’t have to be all that complicated.

Above all, wouldn’t you agree that having clarity and a calm state of mind when trading makes it a much more enjoyable process?

Swayed by emotions? Unsure when to take action? While discretionary trading is not bad, perhaps systematic trading is what works for you. Discover the intricacies of it as we journey along this series.

If you’d like to get a FREE e-course and learn how to better time your trade entries, click the banner below: