Moving Averages in Trading

There are many variations of using these wonderful lines, such as: single, multiple, indicator-based.

Using single, double or triple moving averages are fairly common.

Then there’s the other extreme, with 12 moving averages that Daryl Guppy uses in his GMMA approach.

One of the most popular indicators in the world of technical analysis, is also based on Moving Averages, the MACD.

The MACD is a direct derivative of Moving Averages, therefore a 2nd derivative of Price.

It’s based on tracking the difference between 2 Moving Averages to determine trend direction and strength.

Then there are also different types of Moving Averages.

Simple and exponential Moving Averages are the most commonly used types.

However, in this article we will focus on single and double, simple Moving Averages only.

We will leave the uses of exponential type, triple Moving Averages, GMMA and MACD in a future article.

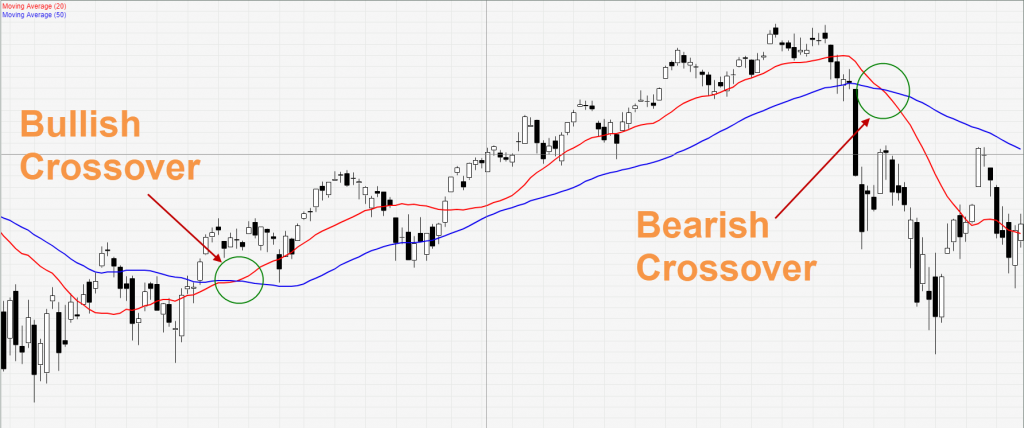

Crossovers (double moving averages)

This one definitely falls into the category of 2 moving averages at least.

A bullish crossover is when the shorter term Moving Average crosses above the longer term Moving Average.

A bearish crossover is when the shorter term Moving Average crosses below the longer term Moving Average.

The key behind the crossover concept isn’t so much of when it crosses over, but that it already has.

This a contextual filter before we move towards the trade setup to get an entry.

If we purely buy and sell just based on the Moving Average’s crossover, we would face an issue:

The periods used to determine the crossover becomes a major determining variable.

However, market volatility constantly changes, trends come and go, lengths of trends are fairly unpredictable.

So the “best” periods to use for the Moving Averages crossover will lose their effectiveness every time the market volatility characteristics shift.

Long run profitability becomes extremely difficult when you have to constantly predict the changes to the coming volatility, in order to make an appropriate shift of “best” periods for your Moving Averages.

So to reduce the reliance on the Moving Average crossover’s accuracy for entry, the more prudent use of the crossover, would be as a contextual indicator for a directional bias on your trades.

Then you’d be looking for your retracement setup or breakout setup for a trade entry in the direction of the crossover.

The exact periods required for the Moving Averages becomes less important, instead the importance shifts to the quality of the trade setup after the crossover, which is offset by trading in the presumed trend.

Overall when used correctly, Moving Average crossovers have a solid place in a sound trading approach.

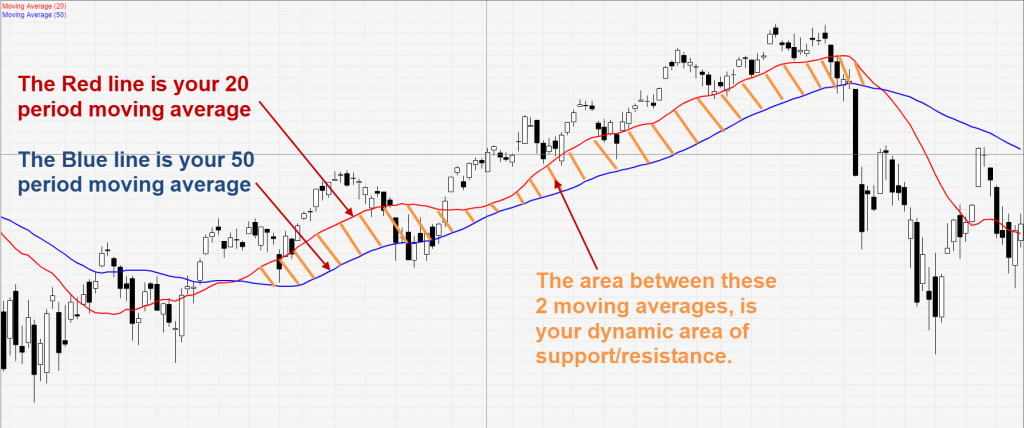

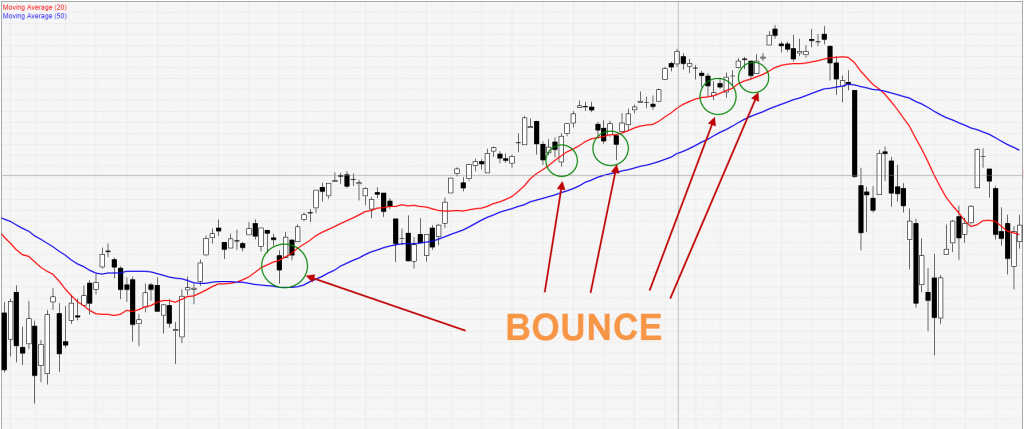

Moving Average Bounces (single and double)

Another popular use of Moving Averages, is as a dynamic level/area of support and resistance.

This can be a single Moving Average or more.

If you’re observing a single Moving Average, the popular ones are 20, 50 and 200 periods, where price is frequently observed to respect and bounce from.

We know that price doesn’t just react off a level and do a sharp turn on a dime.

The challenge here is defining how far you would let price penetrate the MA before you no longer consider it bouncing.

So the solution was to include a longer term MA, the area between the MAs would become an area of dynamic support/resistance.

This is where you would expect price to bounce away from.

Moving Average Breaks (single)

This is the most subjective and difficult use of a Moving Average.

If you’ve been trading for some time, you’ll realize that support and resistance is seldom a single price level.

There tends to be a bit leeway where price will extend beyond your pre-determined levels, before it reacts and bounces away.

So at what point, would you consider a Moving Average broken so you can trade in the direction of the breakout?

This requires you to have a definition for “breaking” a Moving Average, which you are comfortable with, and can repeatedly identify on a chart.

Some known ideas are to:

- Use a % movement beyond a Moving Average.

- Identify a candlestick Close beyond the Moving Average.

- Give a limit to the amount of time spent beyond the Moving Average before a breakout is valid.

- Using Volume to analyse if the breakout move will sustain.

I hope this article has given you a deeper understanding into the uses of Moving Averages in trading.

They are one of the most powerful yet simple, additions to complement your trading approach.