This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

Source: unsplash.com

Are you enjoying the World Cup?

In Singapore, the entire tournament is only aired on paid TV channels.

This is nothing new as exclusive content has always been hidden behind a paywall, as such content is able to attract attention and the dollars that come with it.

DISH Network is one such company that runs on this business model.

And the most important question begets – Should you DISH out your money for this stock now?

Let’s go on a journey to find out.

Brief History of DISH Network

Source: dish.com

DISH Network was founded way back in 1980 as a satellite TV equipment distributor.

Here’s a fun fact – DISH in DISH Network is actually an acronym for DIgital Sky Highway.

Through shrewd acquisitions, embracing new technology, and capable management, DISH Network grew from strength to strength.

Its success can also be attributed to a wide array of services the company provides. Examples include cellular networks, Internet-of-Things, and satellites.

With this knowledge of its history, let’s turn our attention to its business model and financials, shall we?

Business Model and Financials

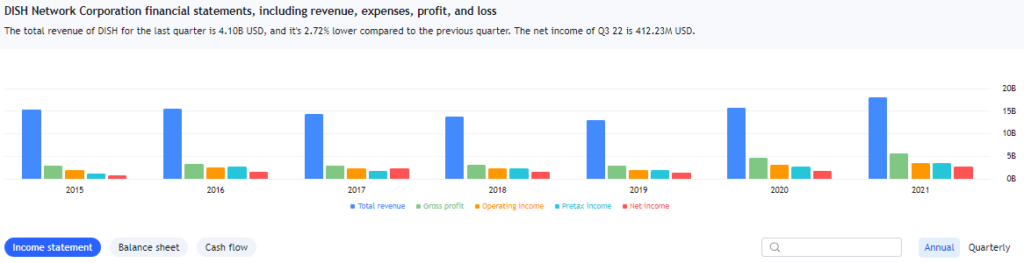

Source: tradingview.com

Let’s have a look at the total revenue that DISH Network earns annually (shown by the blue bar).

Its total revenue has been pretty stable since 2015, hovering between $13+b and $14+b.

2021 was an exceptional year, with its total revenue crossing $17.8b.

How has its net income been performing over the years?

Its net income has been quite irregular; doubling in 2016, rising 40% in 2017, dropping 24% in 2018, maintaining in 2019 and 2020, before shooting 37% in 2021!

Being in the business of providing cellular and satellite networks, DISH Network operates on a subscription model.

This is a powerful business model which is highly envied in the business world.

It’s time to move to the next section of our analysis where we take a look at the chart of DISH Network to determine if you should buy or sell its shares now.

Technical Analysis on DISH Network (NASDAQ: DISH)

Looking at the chart of DISH Network, you can tell that it’s in a downtrend.

Since money is easiest made by following the main trend, you should be looking for shorting opportunities.

The next logical question to ask is – is it time to sell the shares of DISH short?

To answer this question, we need to look at 2 indicators – the arrow and the bar of the Trend Impulse Factor.

Let’s start with the arrow.

There’s a red arrow above DISH Network’s latest candle. This suggests that a new wave of bearishness could be here.

The presence of the red arrow is welcomed as a shorting opportunity could be here. To confirm if you should short the shares of DISH Network now, let’s have a look at the bar of the Trend Impulse Factor too.

Can you tell if the bar of the Trend Impulse Factor is dark green in color?

It isn’t yet.

A dark green bar indicates momentum that’s likely to continue, and in this case, bearish momentum.

Because the bar of the Trend Impulse Factor isn’t dark green in color yet, it’s not likely that this bearish move will continue in the foreseeable future.

Therefore, the time to sell shares of DISH Network short for a position trade isn’t ripe yet.

Conclusion

Source: unsplash.com

The business of providing communication and networking solutions is huge.

DISH Network has been innovative and sound in its business dealings which has enabled it to morph into the giant it is today.

However, its share price has been suffering, sliding for a number of years now.

Yet, it isn’t the right time to short its shares.

Trading stocks without a proper system can be highly risky. This is why the TradersGPS (TGPS) was created.

The indicators (red and green arrows and Trend Impulse Factor) will help you determine if a stock is ready for action to be taken. You won’t have to feel in the dark and make wild guesses.

What should you do in Q4 2022 to grow your portfolio?

Stocks have been really choppy the past few weeks.

But as usual, it’s not the 1st time we have seen such volatility and it pays to constantly remind ourselves to focus on the charts and react accordingly.

The WORST thing you can ever do in a volatile market is to trade aggressively.

Before you know it, reversals will come and go at the most unexpected times to wipe you out.

This is why during such volatile times, you MUST know how to use the right strategies.

In fact, I can tell you as a trader of over 20+ years, profiting in a volatile market is not difficult.

The key here is to NOT fight the volatility head-on.

Lots of people like to challenge the volatility head-on, trying to make predictions or day trade and think they can exit with profits before a reversal happens.

That to me is fighting a losing battle.

Rather, 1 important concept you should understand is this – A volatile market does not mean ALL stocks are volatile.

As you are reading this right now, there are many stocks out there with strong persistent trends that we can capitalize on.

The only part that can be challenging is finding these ‘hidden gems’.

But once you know how to find them, you will literally possess a weapon that can help you find winning stocks with high win-rate while carrying very little risk.

As we see the market continuing to be volatile in the coming weeks…

It’s extremely important to know where and how to find real opportunities and what proven strategies to use that are meant for such situations.

I will be sharing certain strategies that work exceptionally well in such volatile situations to identify and sieve out winning ‘hidden gems’ stocks to capitalize in my upcoming LIVE training (100% free).

Click HERE and join me in my upcoming LIVE training…

And I will show you the full process from identifying winning stocks all the way to executing the trade, and how it can be done in just 15 minutes.

I will also be opening up questions to the floor where you can ask me to analyze ANY stock of your choice,

and I will show you how the TradersGPS system can help you determine if it’s a good buy, WHEN to buy, and WHEN to sell for profits.

Click HERE to register your seat before we hit full capacity!