This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

Former President Donald Trump has survived another assassination attempt.

With 2 scares in 2 months and the Presidential Election in November fast approaching, emotions are running high.

As we head into the final months of the Presidential Election, what can you expect?

It’s safe to say that you can expect increased volatility, so you’ll want your portfolio to be made up of stable stocks.

And this brings me to the shares of Intuit.

Brief History of Intuit

Source: intuit.com

Intuit empowers businesses around the world through its business and financial management solutions.

Founded in 1983, Intuit had created its 1st product, Quicken, a personal finance product.

Sales was through the roof and Quicken dominated the market.

Through strategic and shrewd acquisitions, Intuit has grown into the giant company it is today, with highly successful products such as QuickBooks and Mailchimp under it’s wings.

Has its financial position strengthened over the years?

Let’s find out.

Business Model and Financials

Let’s examine its financial health by looking at its total revenue (in blue) and net income (in yellow).

Starting off with its total revenue, you can tell that this company has been flying high!

Every year since 2018, Intuit has enjoyed a double digit percentage growth in total revenue.

Can the same be said of its net income?

Apart from a stagnation of its net income from 2021 to 2022, Intuit has also experienced a double digit percentage growth in net income.

These achievements are impressive!

However, the most important question to ask is whether market participants are still interested in its shares. Afterall, it’s the movement in its share price that brings you and I the money.

Therefore, let’s analyze its share price.

Technical Analysis on Intuit (NASDAQ: INTU)

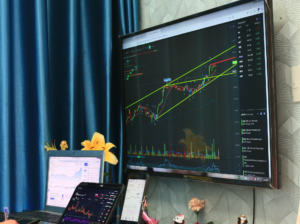

Can you identify the trend of Intuit’s share price?

Overall, its share price is still in an uptrend.

You can infer this from the number of blue candles (solid and outlined) outnumbering the number of red candles (solid and outlined) without having to plot your trendlines or support and resistance.

Since trend following increases your chances of success, you’ll want to be looking out for buying opportunities for a position trade.

Do you see the 2 main indicators on the chart of Intuit?

Yes, I’m referring to the green arrow and Trend Impulse Factor.

The presence of a green arrow under its latest candle tells you that a fresh bullish move is here.

Next, let’s look at the bar of the Trend Impulse Indicator.

More specifically, the color of its bar.

A dark green bar suggests that this bullish move is likely to continue.

What can you conclude?

The time to buy the shares of Intuit for a position trade is ripe!

Conclusion

Intuit began by providing personal finance solutions.

As business grew, it expanded through acquisitions and innovation.

This approach has been met with huge success, with its financial health and share price as testament.

Market participants are optimistic on Intuit’s future as shown by the strong uptrend its shares enjoy.

Most importantly, the proprietary indicators suggest that a new sustainable bullish move is here!

Both the arrow and Trend Impulse Factor indicators have been tested and proven. They form the TradersGPS (TGPS) system to help you decipher if a stock is ripe for a position trade. You won’t have to feel in the dark and make wild guesses.

Therefore, you’ll most likely to profit from buying its shares for a position trade!

What are your thoughts?

Share your thoughts with me below!