Financial Freedom Series: How to Achieve Financial Freedom

It’s literally a game plan because…

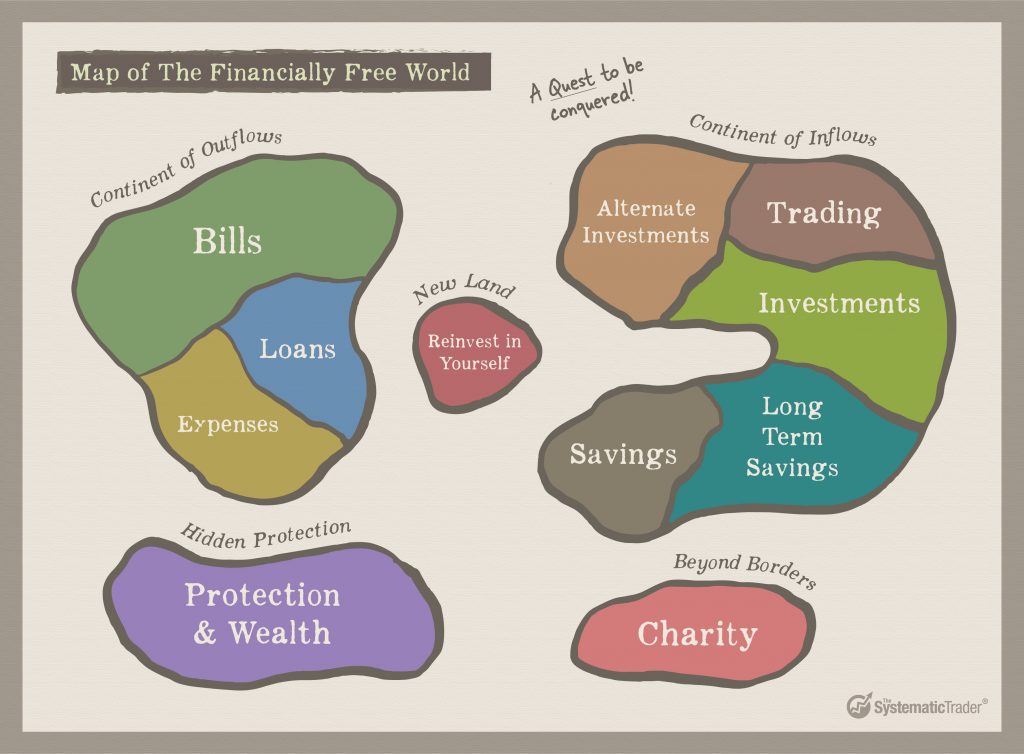

- You can conquer new terrains

- You can unlock new levels

- It is educational (able to learn and have new experiences)

- It involves strategy and planning

- You can gain power-ups and boosters

- There is a last stage boss to be defeated

- You can enjoy the progress and process

Note: The Game Master did not create any cheat codes. Discussion among players is more than welcomed.

Borrowing the gaming lens to view the Road To Financial Freedom is not only fun, but also effective.

You know how there’s this Chinese description “血汗钱”, which literally translates into “blood sweat money” ? Yes, it refers to hard-earned money. But the challenge with treating our money as blood/sweat/tears, is that there are emotions involved. That could lead to stress, emotional financial handling, and even a derailing off the plan.

The goal is to be better stewards of our finances. And on that conquest, financial freedom is the last boss!

Earlier in part 1 of this series, we looked at the mindset in which to approach this subject.

Let’s trust in the process and get moving to the next step – understanding the big picture for financial freedom.

What Is Financial Freedom?

Getting to know the game’s objective is paramount to the game plan. Starting with the basics, here’s an interesting finding about the term “financial freedom”…

That there is, actually, no one agreed definition for financial freedom.

A quick search on Google reveals the following findings:

- Financial freedom means that you get to make life decisions without being overly stressed about the financial impact because you are prepared. You control your finances instead of being controlled by them. Source: DaveRamsey

- Financial freedom is about taking ownership of your finances. You have a dependance cashflow that allows you to live the life you want. Source: Oberlo

- Financial freedom is the ultimate goal for most of us, giving you the ability to live the lifestyle you desire and do exactly what you want with your time. Source: HSBC

- Financial freedom usually means having enough savings, financial investments, and cash on hand to afford the kind of life we desire for ourselves and our families. Source: MoneyFit

- Financial freedom is all about making work an option. Source: Forbes

Of all the definitions out there, I particularly like the 5th one from the Forbes article. Most of us aren’t born with a silver spoon in our mouths. Having to work to earn an income in order to live… Can sometimes be fairly excruciating, or at least tiring. In cases where you are born into a family business, perhaps the silver spoon comes with a condition that you have to labour to keep the spoon in its place.

Regardless, the idea of making work an option is liberating.

What Then Does Financial Freedom Mean?

It is also interesting that the Forbes broke down financial freedom into 8 levels:

- Not living paycheck to paycheck

- Enough money to quit your job (for a bit)

- Enough to be financially happy and still save

- Freedom of time

- Enough for a basic retirement

- Enough to actually retire well

- Enough for a dream retirement

- More money than you could ever spend

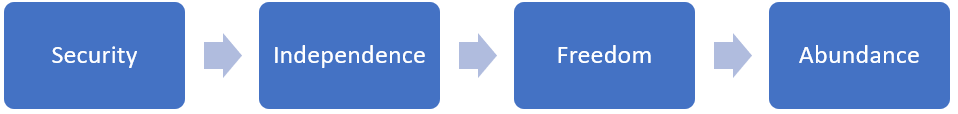

To put it in other words, it’s a process of levelling up:

This made me realize that I was actually really on the road (I’m about a level 3.5)! That was quite an encouragement. Perhaps we are closer to it than we think…

And yes, you can be assured that you and I are on this journey together.

Our Funds Are Like Water

In this capitalist day and age, money is essential to our survival. In a similar vein, it is like how water is essential to the survival of our country, Singapore.

The crucial point is that Singapore has 4 sources of water supply, also known as the Four National Taps:

- Water from local catchment e.g. the reservoirs

- Imported water from Malaysia

- NEWater which comes from reclaimed wastewater

- Desalinated water which comes from seawater

As you can imagine, each National Tap serves as an important water source in ensuring that Singapore’s water supply remains sustainable. The water flows into homes (45%) and the non-domestic sector (55%). While the current usage is at 430 million gallons a day, which is enough to fill 782 Olympic-sized swimming pools, this number is expected to double by 2060. Source: PUB

If a country can have multiple sources of supply to meet its growing demand for water…

Surely we can also have multiple sources of income to meet our various needs.

To have financial freedom means that the supply (what flows in), is more than the demand (what flows out). Specifically when it comes to making work an option, it is when your passive income is able to exceed the amount of expenses – then you’re out of the rat race!

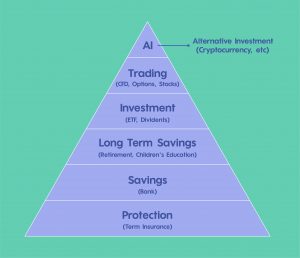

There is much to discuss when it comes to wealth generation and how to grow it sustainably, so I will get into the details of it in an upcoming article.

Of course, wealth protection is also an important topic here, and we will take a closer look at that as we go along this series.

How To Become Financially Free: Reduce Expense, Increase Income

For now, let’s view some numbers to get ourselves visualizing the impending “end game”.

According to Singstat’s latest figures, the average expenditure per household for 2017/2018 is $4,906/month. Assuming that you want to be able to provide for your family, this figure seems reasonable to work with. For ease of calculation, I will round up this figure to $5,000/month.

What would it take to generate $5,000/month? Is this coming from purely your work (active income), or from multiple sources (passive income)?

The simple formula to financial freedom is a combination of reducing expenses and increasing passive income. The less your expenses are, the shorter and faster your road to financial freedom would be. The more you are able to grow your passive income, the quicker you would be out of the rat race.

How Much Do I Need to Retire Early?

As a bonus knowledge section, there is also a movement known as Financial Independence, Retire Early (FIRE).

According to Seedly, followers of the FIRE movement, you would need 25 times the estimated annual living expenses in order to achieve FIRE. Based on the earlier example of a $5,000/month expenditure, this means you would need: $5,000 * 12 months * 25 years = $1.5 million.

Unless it is the lottery’s draw, a stroke of luck from speculative trading, or a sudden inheritance… It is likely that the majority of us don’t have this kind of money to parachute us into early retirement.

But while the numbers may seem large for now, remember what we covered previously?

You don’t have to be daunted by task. Trust in the process, be consistent and don’t give up.

It works even better to treat this as a game to be enjoyed.

Now go ahead to devise your game plan (big picture). Also, think about some ways you can already see the game play (reduce expense, increase income) in effect, and work this to boost your winning odds.

Stay tuned to the next parts of this series as we forge ahead into the terrains to be discovered and conquered, and focus on practical, actionable steps which you can take.

If you’d like to get a FREE e-course and learn how to better time your trade entries, click the banner below:

One Response