How Do You Trade In High Volatility?

Well here we are, it’s Brexit voting day. The Brits are voting today and the final results will be out tomorrow. I know you might be tempted to trade the volatility, but I would suggest waiting till next week before taking trades.

For these two days, let’s just sit back and watch the show! Likely the trading environment will be volatile for sometime, so don’t worry about missing out on the opportunities. Here are a few tips to help you with the coming trading environment.

#1 Reduce Size And Widen Stops

Size smaller, stops wider if you are a set and forget type of trader who isn’t always watching the screens.

The reason is simple, volatile environments could see price whipping to your stop-loss levels more easily. So by sizing smaller, you can widen your stop-loss while maintaining your risks.

Usually this is worth it because the volatility would give you more returns if you are right as well.

But the next tip can help you improve your entry or stop-loss placement, so you don’t need to increase your stop-loss distances that much.

BUT for you active traders who always have an eye on the screen, I have another concept to introduce to you.

How about maintain size and trade more often, with reasonably tight stops?

I know, the logic here lies in the face of most common rules of trading in volatile environments.

Here’s the reason for this logic, with higher volatility, you get a lot more opportunities and possibilities of larger returns. Since you are at the screen all the time anyway, why not maximise your trading edge by trading more?

If you make a loss, you have more opportunities to recover. Take a more active role in terms of number of entries and management of trades and re-entries.

But before you consider going down this route, you need to be very sure of your broad context and what drives the broader context, so you can react if it changes. Also very sure of your technical setup and execution so you can focus on taking trades and managing them.

#2 Lower Time Frames

Move to lower time frames to identify trading opportunities.

This is somewhat strategy and market dependent, but in general, if you have a broad context that has the trend with you, going to lower time frames to identify technical entries will still work.

Because of the higher volatility, you’ll expect more movement from price, retracements to be deeper or stop hunts to move further. The volatile price movements will form setups on lower time frames which can use.

You will still need to give more breathing room for your trade to progress, but it should still be less than the increase you would need to give your trades on your usual time frame during heightened volatility.

#3 Don’t Chase Trades. Don’t.

If you missed a trade entry due to fast market movements, it’s ok to let it go. Another trade opportunity will come along soon enough.

New traders, and even experienced traders, will feel a strong urge to join a fast market and chase trades which they missed, or try to catch pips which don’t follow their strategy.

This is normal because the pull of the market action calls to us. We want to be part of the action!

But exercise your self-discipline, don’t randomly jump into the market just because it’s moving quickly.

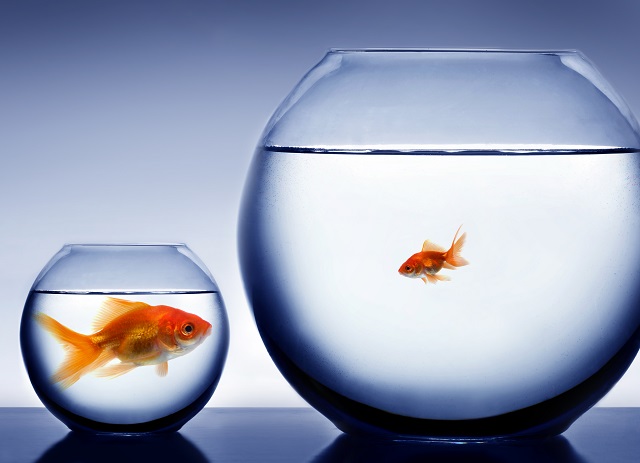

Trading is a marathon, not a sprint. Trading success is a culmination of numerous, continuous, well taken trades.

Trade sharp folks!