This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

Source: unsplash.com

What do you do while waiting in line alone?

Chances are, you’re looking at your phone either watching a video or playing mobile games.

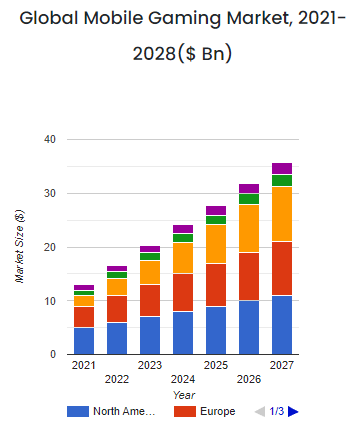

With more smartphone users, mobile gaming is a fast growing industry.

Source: skyquestt.com/report/mobile-gaming-market

You’d expect the companies in the mobile gaming industry to grow, resulting in an astronomical growth in their share prices.

However, is this expectation a reality or a mere fantasy?

Let’s dive in to examine this gaming company – Take-Two Interactive Software.

Brief History of Take-Two Interactive Software

Take-Two Interactive Software was founded in 1993.

It wasted no time and acquired a software publisher.

This trait of Take-Two Interactive Software soon became a trademark. The company expanded fast through business partnerships and acquisitions.

Discovering that sports simulation gaming was a large and untapped market, Take-Two Interactive Software worked hard to develop games in this segment.

Take-Two Interactive Software launched and bought over games after games, with Grand Theft Auto, NBA 2K, Farmville, and more becoming global hits.

However, its journey to massive success was rough. The company had to deal with lawsuits and other legal issues before becoming the gaming giant it is today. This is perfectly normal for a growing company in a fast-growing industry.

The next question to ask naturally is: Is Take-Two Interactive Software financially healthy and strong?

Business Model and Financials

Source: tradingview.com

A quick glance at the bar chart above and you’ll notice that Take-Two Interactive Software’s total revenue is on the rise. This is welcomed for any company, signaling growth.

Can the same be said of its net income?

Its net income has been growing between 21% and 300% year-on-year from 2015 to 2020! Those are astonishing figures.

But, its net income has declined for the first time in 2021, recording a drop of more than $200m, or 31.3%.

Should this be a cause for concern?

I think so.

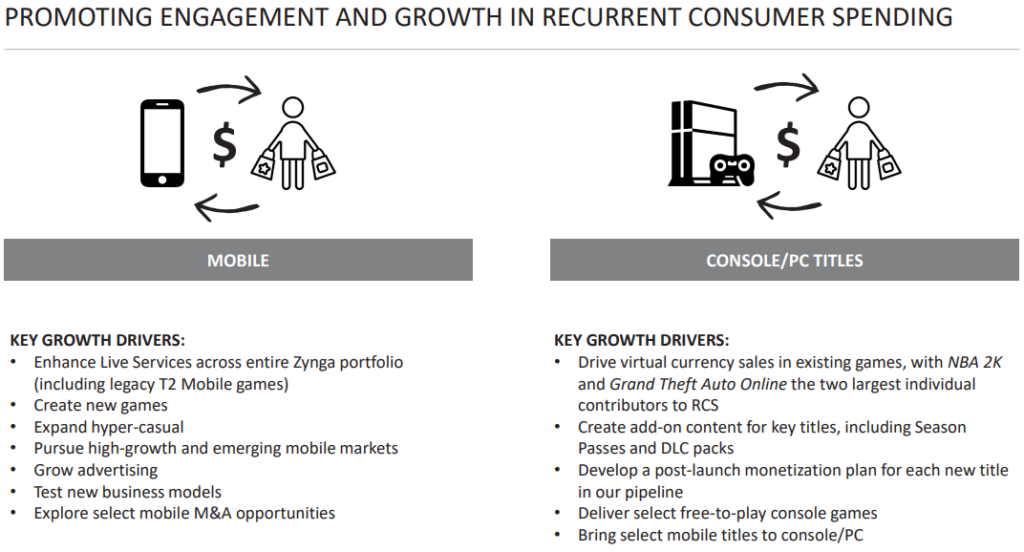

Take-Two Interactive Software has a plan which was shared in its presentation to investors.

Source: ir.take2games.com/static-files/f0f9ff64-0b90-4781-bd7c-76e016e03a1e

Source: ir.take2games.com/static-files/f0f9ff64-0b90-4781-bd7c-76e016e03a1e

The future sure looks exciting. What about the present and near future?

To get an idea, let’s turn our attention to the chart of Take-Two Interactive Software in the next section.

Technical Analysis on Take-Two Interactive Software (NASDAQ: TTWO)

Can you tell whether the share price of Take-Two Interactive Software is in an up or downtrend?

Yes, you are right! It’s in a downtrend.

Here are 2 quick ways to tell the trend:

- There are many more red candles (outline and body) than blue candles (outline and body)

- There are more red down arrows than green up arrows

Do you see a red down arrow above its latest candle?

That red down arrow tells you that a new downtrend is formed. However, should you sell the shares of Take-Two Interactive Software short now?

Let’s have a look at its Trend Impulse Factor indicator.

The color of its Trend Impulse Factor indicator bar isn’t dark green. A dark green bar indicates the possibility of continued momentum, which will be helpful as money is only made when there’s a sustained price movement.

Therefore, I think that the share price of Take-Two Interactive Software may not get slammed anytime soon; its shares isn’t ripe for a position trade yet.

Conclusion

Source: unsplash.com

The mobile gaming industry is expected to continue its explosive growth.

Being in the industry, Take-Two Interactive Software is poised to benefit. However, its finances hasn’t been rock solid. This is a concern and brings us to the chart of its share price.

Even though its share price is in a prolonged downtrend, the tried-and-tested indicators aren’t suggesting that you should short its shares.

Trading stocks without a proper system can be highly risky. This is why the TradersGPS (TGPS) was created.

The indicators (red and green arrows and Trend Impulse Factor) will help you determine if a stock is ready for action to be taken. You won’t have to feel in the dark and make wild guesses.

1 Simple Strategy To Reap Explosive Profits This Year (2023):

2022 by far has been one of the toughest years to trade in the past 5 years.

Lots of Singaporeans who dabble in trading or investments have suffered badly this year.

From inflation, interest rates, Ukraine war, financial tensions between US & China, and most recently, the dramatic crypto meltdown…

We’ve seen nothing short of constant volatility and a persistently declining stock market this year.

Many people I know have incurred 5 to even 6 figures losses and others are holding on to 20-80% unrealized losses.

It’s unfortunate to see that the goals of becoming financially independent to provide better lives for their family have turned into losses for many.

Yet, as a matter of fact, all these losses could have been easily prevented and turned into profits instead if these people had the right knowledge.

Having the right knowledge, and having a tested and proven methodology for trading strong stocks

– This is exactly what helped me and over 5000+ of my students to end the year with decent gains in our portfolio despite the odds stacked against our favor.

Within our SMT community, we use a really simple yet powerful 3-step system that allows us to identify and capitalize on strong stocks.

This is why even amidst the poor performing market this year, we are still able to extract extensive profits from the market – by identifying ‘hidden gem’ opportunities.

And if we are able to reap decent gains in such a bad market this year, think about how immense the profit potential would be like in 2023…

Especially when the market is poised to trend stronger upwards in 2023 and the number of opportunities would be greater than ever.

With that said, it is extremely important to know what to do and how to best take advantage of the markets in 2023 while maintaining a really low risk.

I will be sharing about the ONE strategy you’ll ever need to know to reap maximum profits in the market in my upcoming LIVE training (100% free).

This training will be nothing like you’ve seen before.

I will hold nothing back to reveal my exact game plan and strategy to skyrocket your portfolio in 2023.

Register now here before seats are capped out.

I will show you the full process from identifying winning stocks all the way to executing the trade, and how it can be done in just 15 minutes.

I will also be opening up questions to the floor where you can ask me to analyze ANY stock of your choice,

The biggest gains are not made during an ongoing bull market, but from the preparation before the bull market even happens.

There is no better time than now to be introduced into the world of profitable stock trading.

After all, what excuse do you have to not pick up the skill to capitalize on this impending huge opportunity at this very moment?

I’ll see you real soon!

Click HERE to register your seat before we hit full capacity!