This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

President Donald Trump is loving the limelight.

One moment, he’s slapping reciprocal tariffs on every country. The next moment, he’s partially removing them for most countries, except China.

Because the stock market doesn’t like uncertainty, it has been turbulent recently. Through it all, a potential trading opportunity has appeared.

Let’s dig in together!

Brief History of CrowdStrike

Source: crowdstrike.com/en-us

CrowdStrike is a relatively young company founded in 2011.

The company is a leading cybersecurity products and services provider.

Armed with investments soon after its founding, CrowdStrike launched its 1st product. Its next few products were launched in a rapid fire.

As such, the company gained wide recognition and praise.

However, this wasn’t without challenges. CrowdStrike faced a severe outage in 2024 which crippled banks, airlines, and even emergency services. Since then, the company hasn’t let its customers down.

Business Model and Financials

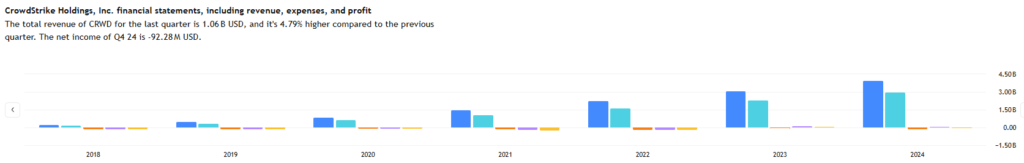

Source: tradingview.com

Let’s look at 2 key metrics from the image above – total revenue (in blue) and net income (in orange).

From the bar chart above, can you tell that CrowdStrike’s total revenue has been growing every year? This is a an extremely positive sign.

Has its net income also been growing every year?

Unfortunately, the same cannot be said of its net income. Its net income has been pretty inconsistent, dropping in 2019, 2021, and 2024 while experiencing growth in 2020 and 2022.

I find that this is the norm for young technology companies, so there’s no cause for concern.

Apart from its strong fundamentals, are there technical reasons to buy this stock?

Technical Analysis on CrowdStrike (NASDAQ: CRWD)

Here’s the chart of CrowdStrike’s share price.

Without the need for technical tools such as trendlines and support and resistance, you can tell whether the time to buy its shares for a position trade is ripe.

Let’s first identify the trend of its share price. This can be easily read by comparing the number of blue candles (solid and outlined) against those in red (solid and outlined).

With more blue candles, it’s clear that the share price of CrowdStrike is in a strong uptrend. Thus, I’ll want to find a buying opportunity to profit from its shares.

Buying shares can be costly if I buy at a random price.

Here, I have 2 main proprietary indicators to help me determine whether the time to buy its shares is ripe. The first indicator is the arrow.

Do you see a green arrow under the latest candle of CrowdStrike?

The appearance of a green arrow suggests that a new bullish move is here!

But, that’s not enough information.

Enter the Trend Impulse Factor indicator.

When the color of its bar is dark green, that tells us that this bullish move is likely to be sustainable. Hence, buying its shares for a position trade would be a good idea.

Although the color of its bar isn’t dark green yet, I believe that it will turn dark green in the next few days.

Hence, I’ll want to keep this stock in my watchlist and buy it when the arrow reappears and its Trend Impulse indicator’s bar is dark green in color.

Conclusion

Source: unsplash.com

After being dumped due to the tariff war and global uncertainty, CrowdStrike’s shares are showing signs of a recovery.

This is an encouraging sign, given that it enjoys a strong foundation.

An analysis of its share price tells me that a fresh bullish move is here. However, bullish momentum could prove to be fleeting until there’s a confirmation.

This can be easily inferred from the green arrow and the color of its Trend Impulse Factor indicator.

Both the arrow and Trend Impulse Factor indicators have been tested and proven. They form the TradersGPS (TGPS) system to help you decipher if a stock is ripe for a position trade. You won’t have to feel in the dark and make wild guesses.

Therefore, you’ll want to place CrowdStrike in your watchlist and monitor it for a position trade.

What are your thoughts?

Share your thoughts with me below!